Compliance Overview

Automate your compliance practices and stay current with FTC Safeguard Rule requirements

Automate your compliance practices and stay current with FTC Safeguard Rule requirements

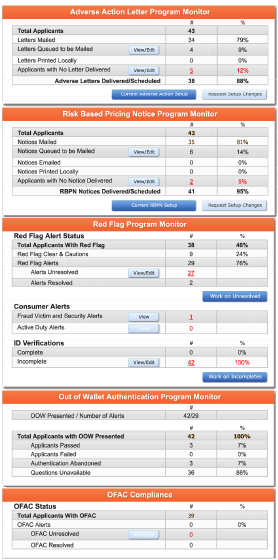

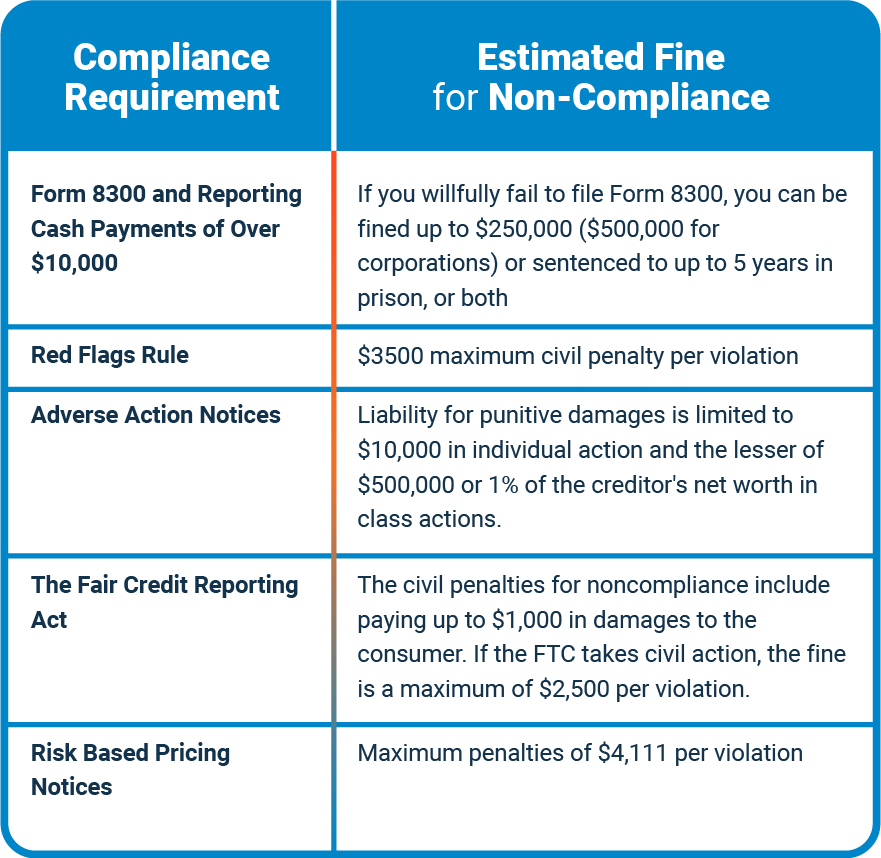

Complying with the Fair Credit Reporting Act (FCRA) and Equal Credit Opportunity Act (ECOA) regulations is key to dealership success. 700Credit offers customizable products and services to automate compliance practices, keeping dealerships ready for future audits.

Dealers are fined millions of dollars every year for not following the proper government regulations around the accessing and handling of customer’s sensitive credit data.

As the largest reseller of credit reports from all three bureaus – Experian, Equifax and TransUnion – 700Credit has always strived to provide comprehensive and automated compliance solutions to keep you compliant with every credit report pulled.

To further our efforts in providing the best compliance and risk mitigation services to our clients, we offer a web-based, self-paced LMS which will provide the required training your dealership needs to remain compliant with every transaction and avoid costly fines.

The Federal Trade Commission (FTC) has finalized changes to the Standards for Safeguarding Customer Information rule (Safeguards Rule) under the Gramm-Leach-Bliley Act (GLBA). The updated Safeguards Rule amends the FTC’s 2003 Safeguards Rule and requires financial institutions (which includes Dealers) to strengthen their data security safeguards to protect customer financial information..

Fill out the form and a 700Credit representative will contact you within 24 hours to get you activated as quickly as possible.