Company Updates

Stay connected with what's happening at 700Credit.

February 20, 2026

Ken's Corner: Today’s Digital Deal Jacket: From Static Storage to the Living Heart of the DealThe days of the digital folder—a mere graveyard for scanned PDFs and stat...

December 15, 2025

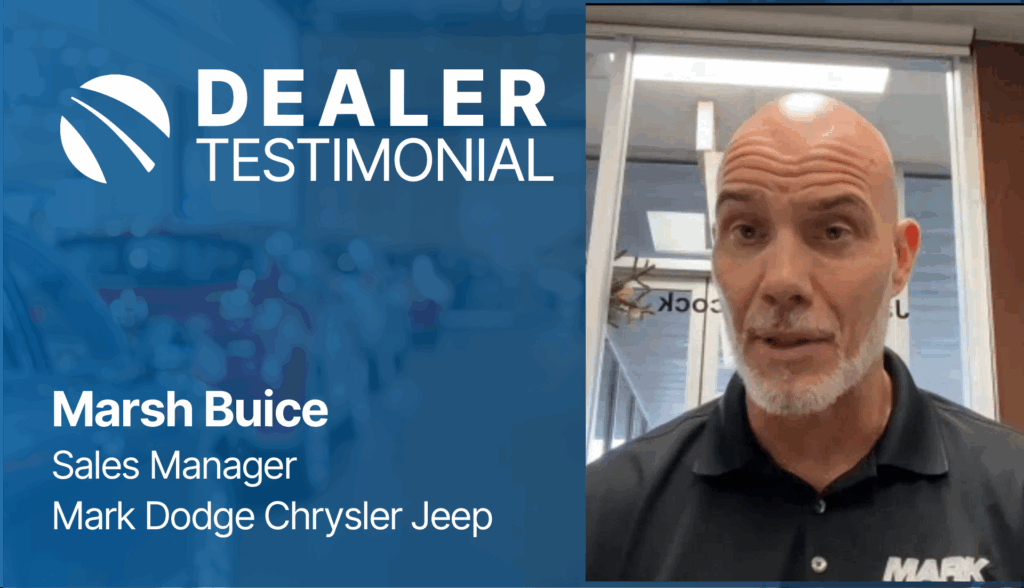

Mark Dodge Chrysler Jeep Testimonial on 700Credit's Fraud Prevention & Digital Deal Jacket IntegrationsMarsh Buice, the sales manager at one of our dealer partners, Mark Dodge Chrysler Jeep, recently provided a video testimonial describing ...

October 17, 2025

700Credit and Ken Hill's Fraud Prevention, Compliance and Data Security Efforts to Profiled by GRC Outlook!GRC Outlook recently profiled 700Credit, particularly regarding our use of state-of-the-art tech solutions to combat fraud, and address g...

Webinars

Knowledge is power, which is why we provide our customers with webinars that ensure your dealership's profitability, safety and compliance. Sign up for one of our upcoming events or view an on-demand webinar at your leisure.

On-Demand

On-Demand

On-Demand

On-Demand

On-Demand

On-Demand

On-Demand