Revvable Email Campaign

Thank you for your interest in 700Credit. Please fill out the form and someone will be in contact with you shortly.

Integration Overview

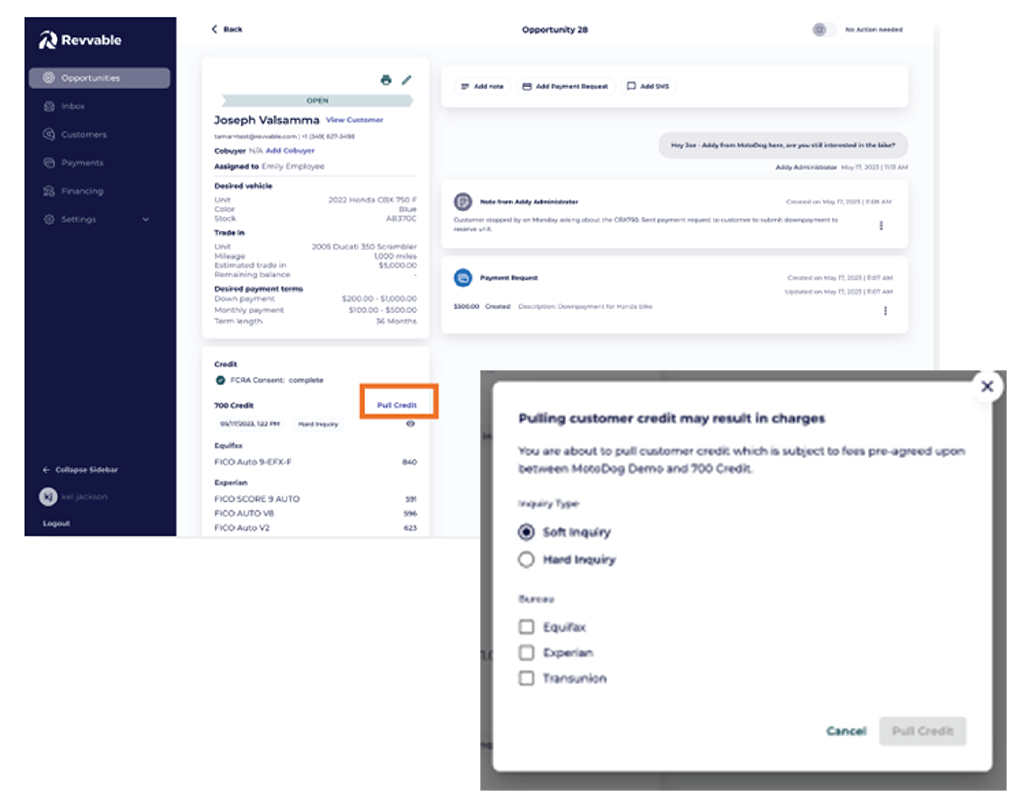

Revvable has integrated our credit reports, automated compliance platform and prescreen soft-pull solutions into their platform.

Credit and Compliance Solutions

700Credit is the largest provider of credit, compliance, and soft-pull solutions to automotive, RV, Powersports, and Marine dealers across the country and the leading authorized reseller of credit reports from Equifax, Experian, and TransUnion.

700Credit is seamlessly integrated with the Revvable DMS so dealers can seamlessly pull credit reports and receive the following information with every report pulled:

- All 700Credit clients receive their choice of credit report format and score.

- Identity Verification/Red Flag platform which provides a vital service by flagging application information that on the surface may seem true, but in reality, is questionable. These warning messages focus on high-risk applicants, social security numbers, and addresses.

- Tabs for each credit report pulled, and Risk Based Pricing and Adverse Action notices (if applicable)

- Link to the Compliance Dashboard which enables dealers to stay on top of and manage credit reporting and compliance from one single view.

Revvable Interface

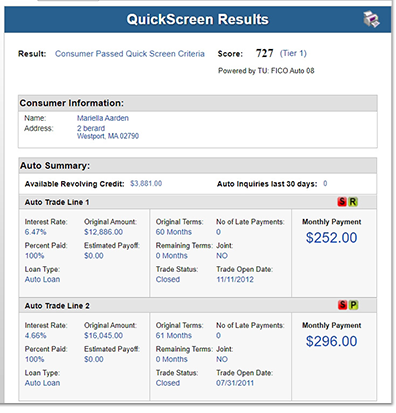

Prescreen (QuickScreen)

Quickscreen is a soft-pull solution that does not require SSN or DOB and does not affect the consumer’s credit score. QuickScreen provides the following information to help dealers sell cars from the service lane:

- FICO® Score

- Summary of Auto Trade Lines including:

- Current Monthly Payments

- Current Auto Loan Interest Rates

- Remaining Balance / Payoff

- Payment History

- Months Remaining on Auto Loan

Benefits of Prescreen Integration

- Saves time and can potentially shorten the sales cycle by enabling you to work the right deal sooner in the sales process with the proper interest rate and a payment the customer can afford before a hard pull is done

- Customers can know what they can qualify before they get to the finance office, preventing a potentially uncomfortable situation or loss of interest

- Helps to prioritize leads from all inbound sources by identifying your best opportunities based on credit profile

- Identify opportunities to upsell in the service lane

- Improves closing ratios

- Helps hold deal gross

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk