Thank you for your interest in 700Credit. Please enter your contact information below.

CDK Credit is built to be available in any part of the CDK workflow you are in.

- If you’re working with a customer in CDK CRM (formerly Elead) and need to run their credit you have access right from within CRM.

- If you don’t run it in CRM but move to quoting your customer in CDK Desking, the same CDK credit solution is accessible from within CDK Desking.

- For dealers who may not run the customer’s credit until F&I, you have that functionality as well. It is meant to be accessible when you need it in your workflow.

Regardless of where you run Credit, all credit activities flow into ONE CDK Credit Summary screen (shown below) that allows you to pull up any of your transactions from any of the layered apps.

Integration Overview

700Credit has announced product integration with the CDK Digital Retail platform (formerly known as Roadster) platform. The new alliance integrates our prequalification platform seamlessly into the digital retailing process, offering consumers an opportunity to see their credit score range by simply entering their name and address.

Introduction to Prequalification

- The 700Credit prequalification platform is our web-based lead generation platform that does not require a consumer’s SSN or DOB and has no effect on their credit file.

- Presented with a simple lead form, consumers can quickly get prequalified for a vehicle while going through the CDK Digital Retailing process.

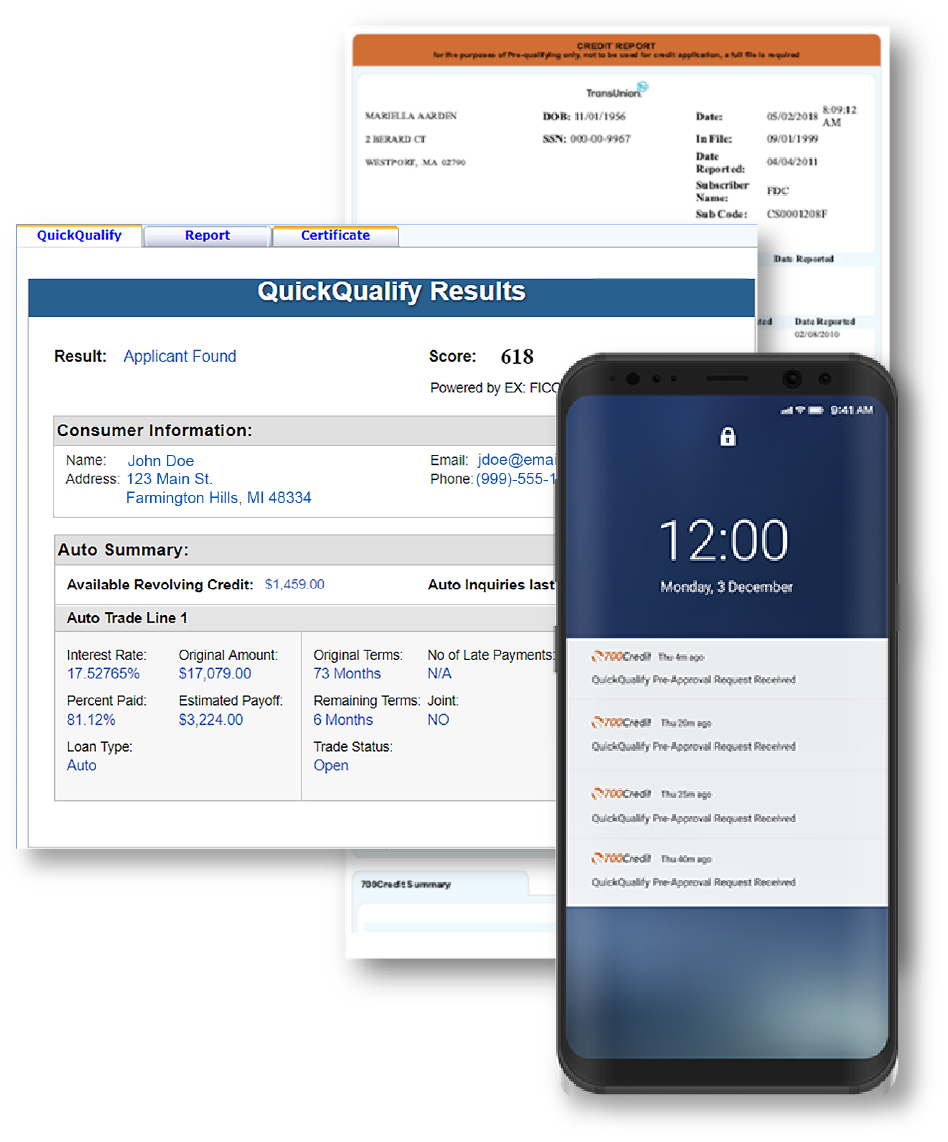

- Dealers receive a FICO score and full credit file making it easy to estimate payments and understand what the consumer is qualified for before the first phone call.

- Our QuickMobile app makes it easy and convenient for dealers to receive and respond to customers who have run through the prequalification process.

Benefits of Prequalification in Digital Retailing

The integration of the 700Credit prequalification platform into the digital retailing process provides benefits to both dealers and consumers:

- Soft pulls can help dealerships save money on credit pulls. Soft pulls give you the same visibility into your shopper’s credit history for a fraction of the cost.

- Dealers receive a full credit file and FICO Score without placing a hard inquiry on the consumer’s credit file.

- Consumers that are prequalified early in the sales process are PROVEN to generate higher lead conversion rate than those that were not

To learn more or to get started today, fill out the lead form above and a representative will contact you shortly.

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk