Thank you for your interest in 700Credit. Please fill out the form and someone will be in contact with you shortly.

700Credit and Affinitive Partner to Bring Prescreen to the Service Lane!

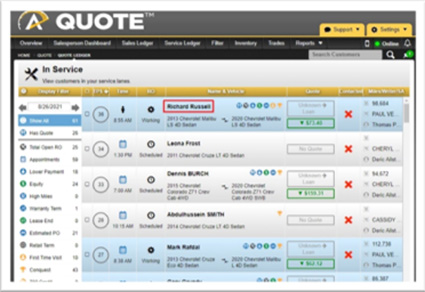

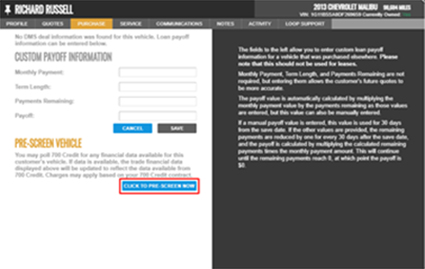

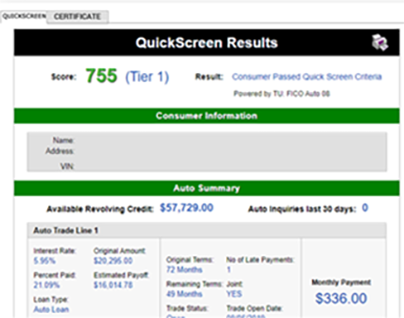

Affinitive has integrated 700Credit’s soft pull prescreen solution (QuickScreen) into their Quote platform to expand sales opportunities sourced from a dealer’s service lane business. With Quickscreen you can now gain the necessary insights to those vehicles in service that were NOT purchased at your store – conquest customers. The prescreen data provides the information necessary to enable the Affinitive Quote product to deliver net new customers. Knowing the amount owed on a vehicle allows Quote to calculate the vehicle’s equity – the missing data point for a proposed payment calculation. And current payment amount allows Quote to show proposed payment vs payment today.

Prescreen Introduction

Quickscreen is a soft-pull solution that does not require SSN or DOB and does not affect the consumer’s credit score. QuickScreen provides the following information to help dealers sell cars from the service lane:

- FICO® Score

- Summary of Auto Trade Lines including:

- Remaining Balance/Payoff

- Current Monthly Payments

- Lease or Loan

- Current Auto Loan Interest Rates

- Payment History

- Months Remaining on Loans

- Available Revolving Credit

- Auto Inquiries last 30 days

Benefits of Prescreen Integration

- Gain visibility into credit worthiness – See a FICO® Score and equity position without posting a hard inquiry on a consumer’s credit file

- Expand sales opportunities sourced from a dealer’s service lane business. Prescreen integration enables dealers to provide offers for vehicles not purchased at your store (conquest customers), resulting in net new customers

- Knowing the amount owed on a vehicle allows Quote to calculate the vehicle’s equity – the missing data point for a proposed payment calculation.

- Saves time and can potentially shorten the sales cycle by enabling you to work the right deal sooner in the sales process with the proper interest rate and a payment the customer can afford before a hard pull is done

- Customers can know what they can qualify before they get to the finance office, preventing a potentially uncomfortable situation or loss of interest

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk