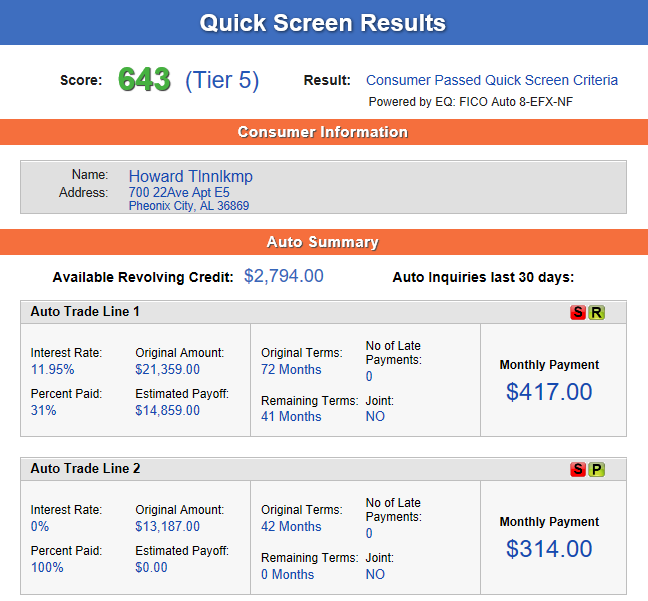

The following data is available with QualiFi (QuickScreen):

- Live FICO Score

- Available Revolving Credit

- All open auto tradeline data including:

- Monthly Payment

- Current Interest Rate

- Original Loan Amount

- Estimated Payoff

- Remaining Payments

Thank you for your interest in 700Credit. Please fill out the form and someone will be in contact with you shortly.

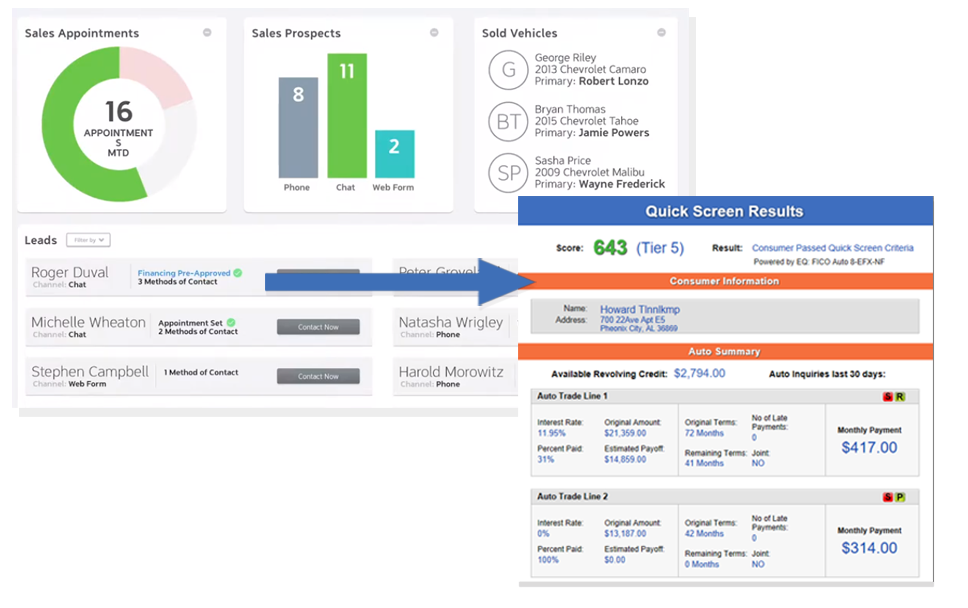

700Credit has partnered with ActivEngage to provide QualiFi – an integrated prescreen solution within the ActivEngage managed chat platform. QualiFi gives you visibility into your customer’s credit profile before you work the deal, so you can work the right deal, right away, saving time and preventing a potentially uncomfortable situation for your customer. QualiFi can also help you provide the customer with a payment estimate based on the car they are interested in. In addition, knowing the customer’s current car payment and loan payoff amount enables your team to have more meaningful budget conversation with the client, potentially shortening the sales process, getting you to the finish line faster.

The following data is available with QualiFi (QuickScreen):

The ActivEngage chat agent captures the customer name and address (no SSN or DOB required) during the conversation, and once they submit the lead, it will be prescreened for the dealer and the data will be available to access in 3 locations:

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk