Thank you for your interest in 700Credit. Please fill out the form and someone will be in contact with you shortly.

Integration Overview

CarNow has integrated 700Credit’s soft pull prequalification with their Digital Retailing and Chat product offerings. Consumers have the opportunity to get prequalified earlier in the sales process. Dealers will be empowered with the consumer’s FICO score and complete Credit Report – leading to better customer conversations and experiences, and ultimately increased sales.

CarNow has also created a finance application with their DR tool that integrates our credit application capture process that automatically pushes consumer data into RouteOne, Dealertrack and CUDL.

Benefits of CarNow Credit Application

- Integrated with the 700Credit web-based finance application that seamlessly saves consumer information captured and pushes the data to DealerTrack, RouteOne and CUDL.

- Provides a digital-first, mobile-friendly experience makes applications easy to complete.

Introduction to Prequalification

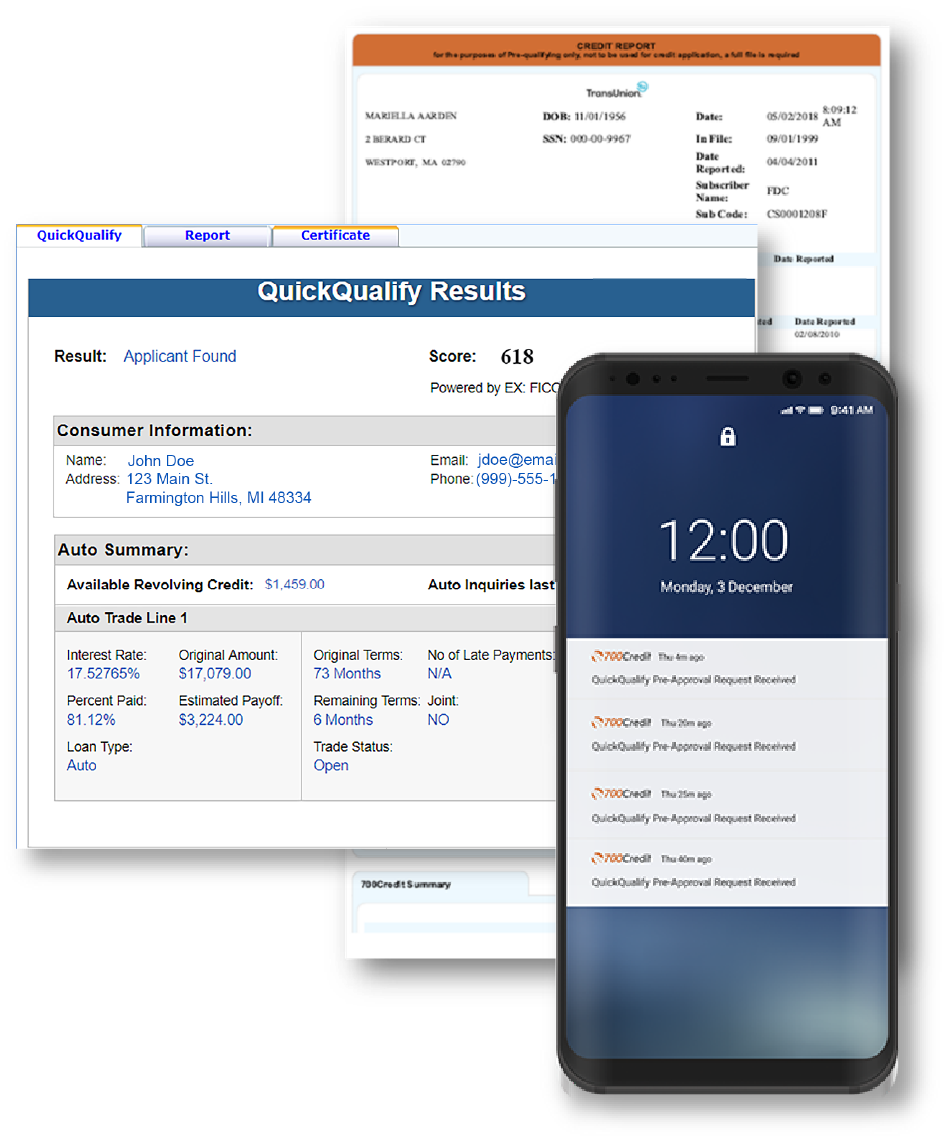

The 700Credit prequalification platform does not require a consumer’s SSN or DOB and has no effect on their credit score. Presented with a simple lead form, consumers can quickly get prequalified for a vehicle and receive an accurate payment quote while going through the CarNow digital retailing process. Dealers receive a FICO score and full credit file making it easy to estimate payments and understand what the consumer is qualified for before the first phone call. Our QuickMobile app makes it easy and convenient for dealers to receive and respond to customers who have run through the prequalification process.

Benefits of Prequalification in Digital Retailing

The integration of the 700Credit prequalification platform into the digital retailing process provides benefits to both dealers and consumers:

- Soft pulls give you the same visibility into your shopper’s credit history for a fraction of the cost.

- With the consumer’s actual FICO® score incorporated into the rate calculation, more accurate payment quotes are provided to consumers through the digital retailing tool.

- Dealers receive a full credit report including FICO® Score, amount owed on vehicle for an accurate equity calculation, months remaining on loan or lease and current monthly payment.

- Consumers see their current FICO® score range and get pre-approved for a vehicle loan.

- Consumers that are prequalified early in the sales process are PROVEN to generate higher lead conversion rate than those that were not.

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk